Mine, Yours, Ours: Balancing Individual and Joint Finances in Relationships

Mine, Yours, Ours: Balancing Individual and Joint Finances in Relationships

In any romantic relationship, managing finances can often be as complex as navigating emotional intimacy. The interplay between individual and joint finances can create tension and misunderstandings. This article aims to help couples understand the importance of financial balance, providing practical strategies to blend personal and shared finances effectively. By the end of this discussion, readers will have a clearer perspective on how to constructively manage their finances as a team, enhancing the overall health of their relationship.

Understanding the Issue

Money is not just a means of exchanging goods and services; it carries emotional weight and can significantly influence relationship dynamics. According to a study published in the Journal of Marriage and Family, financial issues are among the most common stressors cited by couples, often leading to conflict, dissatisfaction, and even separation. It’s essential to recognize that each partner brings unique financial backgrounds, values, and stressors to a relationship, which can complicate money management.

For many couples, financial disagreements arise from mismatched spending habits or differences in financial priorities. One partner may prioritize saving for a home, while the other may prefer to spend on travel experiences. The key to navigating these differences lies in open communication and mutual understanding. Recognizing that financial conversations can be uncomfortable is the first step in fostering an environment where both partners feel heard and respected.

Practical Solutions and Insights

- Open Communication About Money: Having regular and open discussions about finances is crucial. Set aside time each week or month to review your budget, expenditures, and savings goals. Encourage each other to share financial aspirations and concerns, ensuring both partners feel involved and valued. Make it a practice to discuss any significant purchases or changes in income, as transparency builds trust.

- Establish Joint and Individual Budgets: Creating a financial plan that includes both joint and individual budgets can help maintain the balance between shared and personal financial goals. For instance:

- Joint Budget: Allocate funds for shared expenses like rent, utilities, groceries, and joint savings. This helps in creating a financial foundation as a couple.

- Individual Budgets: Set aside a portion of your income for personal spending that allows each partner to pursue their interests individually. This can reduce feelings of resentment over personal lifestyle choices.

- Create Financial Goals Together: Discuss your short-term and long-term financial goals together. Whether saving for a house, planning for a vacation, or preparing for retirement, having shared objectives helps unite the couple’s efforts. Use SMART criteria to define these goals more clearly, ensuring both partners are on the same page.

- Automate Savings and Track Spending: Taking advantage of technology can simplify financial management. Consider automating savings contributions to joint accounts for shared goals. Additionally, utilize budgeting apps that allow both partners to track expenditures and stay aware of financial standings. This not only simplifies the process but also provides transparency, helping to diffuse potential conflicts.

- Be Open to Adjustments: Life brings constant changes—job changes, unexpected expenses, or shifts in priorities. As circumstances evolve, remain flexible and willing to revisit your financial strategy together. Encourage each other to express concerns if one of you feels overburdened or restricted by the current financial setup.

- Educate Yourselves Together: Cultivating financial literacy as a couple can enhance your confidence in managing your finances. Attend workshops, read personal finance books, or even take an online course together. The more informed you both are, the better equipped you will be to make sound financial decisions that benefit your relationship.

Conclusion

Balancing individual and joint finances in relationships is not merely about managing money—it’s about enhancing partnership dynamics and fostering a deeper connection. By embracing open communication, establishing clear financial roles, and supporting each other’s financial independence, couples can reduce conflict and strengthen their relational bond.

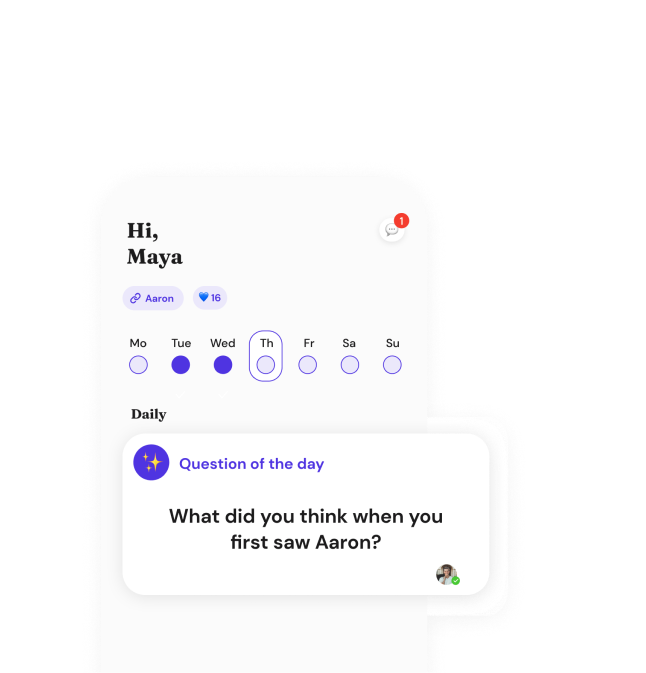

As you navigate the complexities of blending your financial worlds, remember that tools and resources are available to support your journey. Downloading the Recoupling App can be a significant step toward improving your financial conversations and management. With features designed for couples, it helps track expenses, set shared goals, and foster transparency in finances.

Take action today, and start creating a harmonious financial future together! Download the Recoupling App now and make progress towards balance in your relationship.