Open Books: The Importance of Financial Transparency in Relationships

Open Books: The Importance of Financial Transparency in Relationships

In today’s fast-paced world, communication is often the backbone of a successful relationship. However, one area that couples frequently overlook is the financial aspect. Money matters can be surprisingly contentious in relationships, leading to misunderstandungen, resentment, and even conflicts. By embracing financial transparency, couples can cultivate trust, enhance communication, and ultimately, strengthen their bond. This article will explore the importance of financial transparency in relationships and offer practical solutions to achieve a more harmonious partnership.

Understanding the Issue: Why Financial Transparency Matters

When couples enter a relationship, they often bring with them individual financial habits, beliefs, and baggage. Whether it’s differing views on spending, saving, or debt, keeping financial secrets can disrupt the foundation of trust that your relationship is built on. A lack of transparency can lead to feelings of insecurity, anxiety, and betrayal.

According to a study published in the Journal of Family Psychology, couples who openly discuss their financial situation report greater relationship satisfaction. When partners are on the same page financially, they are less likely to experience conflicts that can stem from budgeting, spending, or hidden debts. Financial conflicts can escalate to larger issues of trust, which can ultimately threaten the relationship’s longevity.

Moreover, financial stress can have significant implications for mental health, leading to increased anxiety, depression, and frustration. Understanding where each other stands financially can help mitigate those stresses and foster a more supportive atmosphere in the relationship.

Practical Solutions: Strategies for Financial Transparency

- Start with Open Conversations: Establish a regular time to discuss finances—this could be weekly, monthly, or quarterly, depending on your needs. Use this time to talk about your financial goals, current expenses, and any concerns regarding your finances. Make it clear that these discussions are non-judgmental, focusing on partnership rather than criticism.

- Share Financial Documents: Consider creating a shared folder accessible to both partners that includes important financial documents, such as bank statements, investment accounts, pay stubs, and insurance policies. This transparency not only helps keep both partners informed but also reduces the likelihood of financial secrets.

- Set Joint Financial Goals: Take some time to identify your financial aspirations as a couple. Whether it’s saving for a home, planning a vacation, or preparing for retirement, having shared financial goals can help align your priorities and motivate both partners to stay engaged with your financial situation.

- Create a Budget Together: Collaborate on a monthly budget that reflects your joint income and expenses. Assign roles and responsibilities in managing your finances, providing each partner with a sense of ownership and accountability. Tools like budgeting apps can streamline the process and keep each other updated in real-time.

- Discuss Debts Openly: If either partner carries debt, it’s crucial to discuss this openly. Understanding the details of each other’s debts—such as student loans, credit card balances, or mortgages—can make a big difference in how you approach financial planning and support each other through financial stresses.

- Practice Complete Honesty: Maintaining financial honesty also involves being clear about your personal spending habits and desires. Before making significant purchases, discuss them with your partner. This not only showcases mutual respect but also prevents future misunderstandings regarding finances.

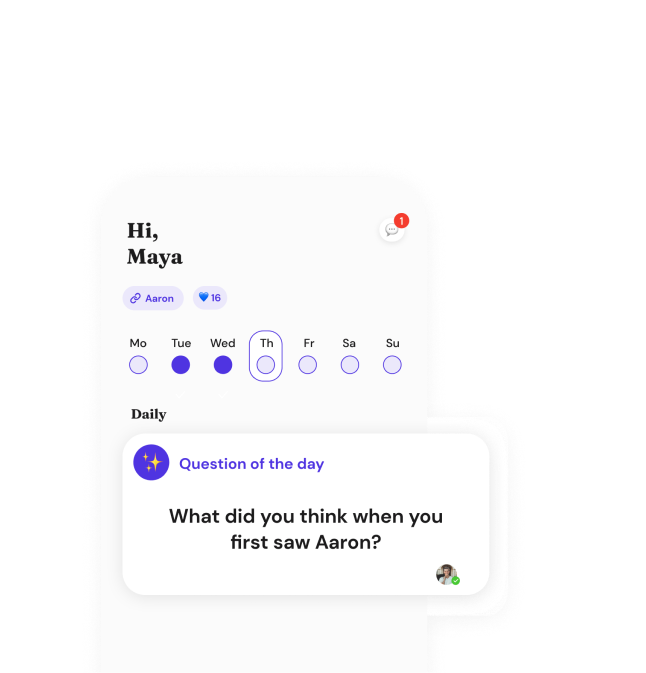

- Utilize Financial Apps: In today’s digital age, financial apps like the Recoupling App can support couples in managing their finances effectively. This tool promotes transparency by enabling partners to track expenses together, set goals, and maintain open lines of communication about their financial choices.

Conclusion: Embrace Financial Transparency for a Stronger Relationship

In conclusion, financial transparency is not merely a suggestion for couples—it’s a fundamental pillar that strengthens relationships. By openly discussing finances, sharing financial documents, and setting joint goals, couples can create an environment of trust and mutual respect. The benefits extend beyond finances, contributing to healthier communication and reducing stress within the relationship.

Taking the first step towards financial transparency may feel daunting, but the rewards are plentiful. Embrace the changes, implement the strategies discussed, and watch your relationship flourish in newfound ways.

For couples looking to deepen their understanding of each other’s financial lives, consider dowloading the Recoupling App today. This innovative tool will help you enhance communication, keep your finances organized, and reinforce the unrestricted support that goes hand in hand with transparency. Don’t wait—transform your financial discussions into stepping stones towards a stronger partnership!