Managing Financial Strain in Long-Distance Relationships

Managing Financial Strain in Long-Distance Relationships

Long-distance relationships come with their own unique set of challenges. While distance can foster emotional growth and intimacy, financial strain often looms large over these partnerships. Understanding and managing financial strain is vital for maintaining the health and happiness of couples separated by miles. This article will explore practical solutions for navigating financial pressures in LDRs, helping couples improve their relationship dynamics and communication.

Understanding the Issue

For many couples, the financial strains of a long-distance relationship can feel insurmountable. The costs of travel, communication, and maintaining two separate households can lead to stress, tension, and even resentment. According to a survey conducted by the Journal of Communication, couples in LDRs reported feeling more anxious about finances compared to their geographically closer counterparts. This anxiety can compound issues related to connection and intimacy, making it crucial to address the financial elephant in the room.

The stakes are high: when financial concerns interfere with the emotional aspects of a relationship, couples may drift apart, leading to misunderstandings and feelings of isolation. Thus, addressing financial strain head-on can help strengthen your bond and foster better communication.

Practical Solutions or Insights

- Set a Realistic Budget: Begin by creating a budget that reflects both partners’ incomes and expenses. Include costs related to travel, gifts, and communication tools. Establishing a clear financial picture can help both parties understand what is feasible and plan accordingly.

- Prioritize Communication: Regularly discuss financial issues and concerns. Setting monthly check-ins can provide an avenue for transparency, where both partners feel comfortable sharing their feelings about finances. This practice not only clarifies expectations but also reinforces trust and cooperation.

- Creative Date Ideas: Reduce expenses by finding innovative ways to connect without breaking the bank. Utilize apps for virtual movie nights or cook the same meal together — all from the comfort of your respective homes. Emphasizing quality time over quantity can foster emotional closeness without compromising your financial goals.

- Plan Visits Strategically: If in-person visits are essential, ensure they align with discounts on travel or events. For instance, booking flights in advance or traveling during off-peak times can save significant money. Additionally, consider meeting halfway to split travel costs.

- Share Expenses: If possible, share the costs of visits, whether by splitting the travel expenses or alternating who travels to see whom. You can also pool resources for gifts; instead of buying an extravagant gift, opt for thoughtful gestures that won’t strain your wallets.

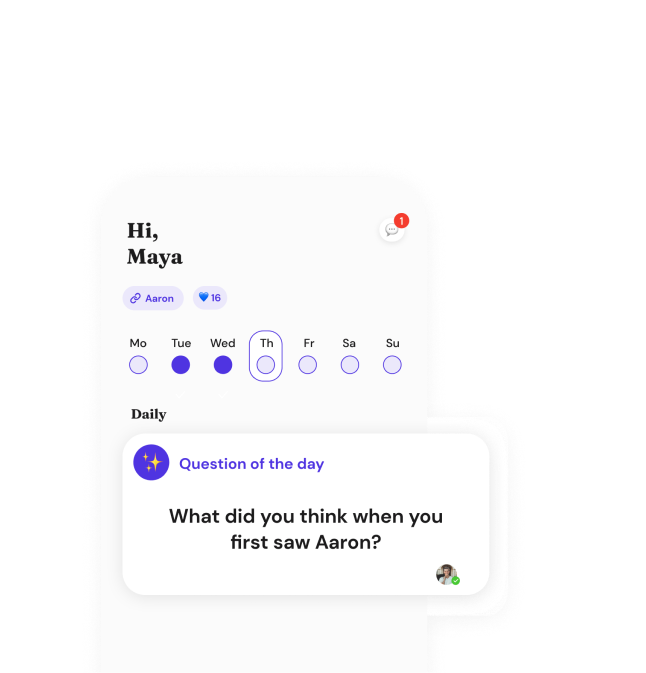

- Leverage Technology: Take advantage of money management apps to track joint expenses. Consider using apps that allow for joint savings goals to help contribute toward future visits or shared experiences. Staying organized with financial planning can alleviate stress and create a sense of partnership.

- Be Mindful of External Influences: Friends and family may unintentionally apply pressure regarding how frequently you should see each other or the level of gifts you should exchange. Keep focus on your own relationship’s priorities and don’t let external expectations dictate your financial decisions.

- Invest in Intimacy: Financial moments can be intimate too. Consider investing in communication tools that enhance your connection. Prioritizing emotional intimacy can create a stronger bond, making financial strains feel less burdensome.

- Plan for the Future: Discuss your long-term plans together regarding how and when to bridge the distance. This can help both partners feel secure and invested in the relationship, alleviating some of the day-to-day financial pressures.

Conclusion or Takeaway

Navigating financial strain in long-distance relationships doesn’t have to be an uphill battle. By being proactive in addressing these concerns, couples can create a more secure, open, and loving environment. From establishing budgets to strategizing visits, the tools provided here aim to enhance both communication and cohesion in your relationship.

In a world where relationships can often feel disconnected, taking control of the financial aspects can foster deeper intimacy and trust. Remember, every relationship is unique, so tailor these suggestions to fit your circumstances and priorities.

Want to take your relationship to the next level? Download the Recoupling App today to access resources, tools, and community support that can help you manage not just finances, but also enhance your overall relationship dynamics. Embrace the journey; your relationship deserves it!