Understand the Impact of Finances on Relationship Stability

Understanding the Impact of Finances on Relationship Stability

Money matters. In a world where financial stability can dictate much of our quality of life, it’s hardly surprising that finances can significantly impact relationship dynamics. The intersection of love and finance can be fraught with tension, leading to misunderstandings, disputes, and, at times, irreparable rifts between couples. This article aims to shed light on the issue of finances in romantic relationships, offering practical advice to empower couples to navigate their financial discussions with confidence and clarity.

Understanding the Issue

Finances are often seen as one of the primary stressors in relationships. According to a survey conducted by the American Psychological Association, nearly 70% of adults reported feeling stressed about money at some point in their lives. This stress can manifest in various ways, such as miscommunications, resentment, and even emotional distance. As we weather the ups and downs of financial stability—be it job loss, unexpected expenses, or differing spending habits—every couple is susceptible to the strain that financial discussions can provoke.

Recognizing the relevance of finances in relationships is crucial. It’s not about the amount of money one has; rather, it’s about how couples manage financial discussions and shared responsibilities. Open communication about finances can create a powerful bond, while failure to address financial issues can lead to conflict and dissatisfaction.

Practical Solutions or Insights

- Establish Open Communication: Communicate openly about your financial situations, including debt, income, and savings goals. Designate time for regular money check-ins to discuss your finances, financial goals, and any concerns you might have. Using non-confrontational language can greatly reduce defensiveness and make discussions more productive.

- Set Shared Financial Goals: What do you want to achieve together financially? Whether it’s saving for a home, planning a vacation, or preparing for retirement, establishing shared financial goals fosters teamwork. Write down these goals together and refer back to them during budgeting sessions to stay aligned.

- Create a Budget Together: Drafting a budget isn’t just an exercise in mathematics; it’s a way to align your priorities. Work together to categorize income and expenses, setting aside funds for savings and discretionary spending. Opt for a budgeting app that can provide transparency and allow both partners to track expenses equally.

- Divide Financial Responsibilities: Every couple is different—while one partner may feel confident managing investments, the other may excel at tracking daily expenses. Divide responsibilities based on strengths to create a system that works for both of you. Regularly review each other’s roles to ensure balance and fairness.

- Educate Yourselves Together: Take time to learn about personal finance as a couple. Attend workshops, read books, or listen to podcasts focused on financial literacy. Gaining knowledge together will empower both partners and harmonize your approach to financial decision-making.

- Address Financial Stress Proactively: Don’t wait until financial stress becomes overwhelming. If tensions rise over finances, take a step back and discuss how you can address them together. Consider seeking the help of a financial advisor or a relationship counselor for guidance.

- Plan for the Unexpected: Life is unpredictable. Building an emergency fund can mitigate stress when unexpected expenses arise. Aim for three to six months’ worth of living expenses saved up. Having this cushion can strengthen a relationship by providing stability and peace of mind.

Conclusion or Takeaway

Navigating finances as a couple is indeed a challenging endeavor. However, approaching this aspect of your relationship proactively can strengthen your bond and foster a sense of teamwork. By establishing open communication, setting shared goals, and managing financial responsibilities together, couples can mitigate stressors and cultivate a more harmonious relationship.

As you implement these strategies, remember that the key is collaboration. You’re not just two individuals managing separate finances; you’re a team working towards common objectives. These efforts can transform your approach to financial conversations, leading to deeper intimacy and mutual respect.

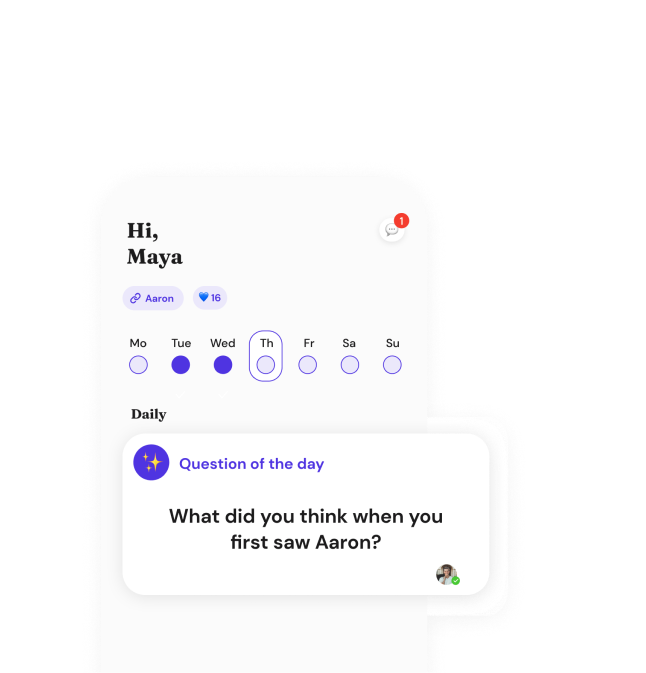

Take the first step towards financial clarity in your relationship today! Download the Recoupling App, a supportive tool designed to help couples navigate relationship dynamics, including financial discussions. Embrace the journey to understanding and stability together.